4.1 SOLA’s Strategy Evolution

SOLA only had three CEOs

|

1. | Noel Roscrow | July 1960 – late 1981 | ~21 years |

|

2. | John Heine | October 1981 – March 2000 | ~19 years |

|

3. | Jeremy Bishop | April 2000 – March 2005+ | ~5+ years |

| Note – Jeremy became CEO in March 2005 of Carl Zeiss Vision following SOLA's purchase by Carl Zeiss AG and EQT with the formation of Carl Zeiss Vision. He remained CEO until Norbert Gorny took over in October 2006 (and was stood down in January 2009). | ||||

Each CEO made major contributions to SOLA but changed strategy to reflect the changing environment. The strategy evolution is partly captured in a memo to senior staff on 7th October 1999 by John Heine. He stated:-

“SOLA’s evolution as a company can be divided into three distinct periods:-

- During the 1960s, SOLA became an international business but organization and market focus were strictly local

- The 1980s brought the regional organization we are familiar with, and a degree of inter-regional coordination

- In the late 1990s we have been making incremental progress towards global thinking and worldwide coordination. The challenge of the next decade is to create a truly global company in terms of strategy, development and the way all parts of the organization work together

SOLA’s early decades were about opening up new markets and supplying them with products. The 1980s brought a marketing focus based on differentiated products and feature-based selling. Our goal for the next decade is to be the lens company that is driven by understanding the customer and building equity in long term partnerships with them.

SOLA pioneered the development of plastic lenses and opened up the world’s markets to them. The 1980s was a decade in which we became a highly successful follower in establishing a major worldwide progressive business that remains critical to our prosperity today. Being a fast follower was good enough. The 1980s also laid the ground for new product developments and value-added growth. Being a fast follower isn’t good enough today. Our goal in the next decade is to establish leadership in our industry in a number of ways that will – if we execute successfully – take us beyond our competition to become:-

- The company that understands and meets the needs of consumers in vision correction for different lifestyles

- The company that establishes true consumer brands based on unique products and services

- The company that creates the perception of eyeglasses as an exciting consumer category and captures the best share of resulting growth in purchases

SOLA’s early growth was the creation of pioneering entrepreneurs whose leadership was (sometimes flamboyantly) individual. They understood competition (with each other as well as externally) better than collaboration. The 1980s organization brought progress in developing team processes at regional levels and the larger SOLA companies adopted a team based approach to managing the business. More often than not, territorial issues got in the way of intercompany collaboration. As we approach the millennium, we have made progress on the path towards global coordination in some key areas (e.g. global product standards) based on dialogue and partnership that focus on the things for SOLA. In the next decade this must become the standard for the way we work together. This philosophy is the foundation of our new organization structure and the business process that will support it.

We are to become the customer-focussed leader, based on effective global partnerships, there are three ‘must haves’:-

- Clear vision and focus

- Determined execution of our chosen strategies

- An organization that is aligned with our strategies, clear on our objectives and measured by the right performance indicators”

By March 2002, under Jeremy’s leadership, SOLA’s Top Ten Priorities had become:-

- Deliver predictable performance versus expectations of

- Customers

- Equity Investors

- Debt Investors

- Complete manufacturing/cost reduction plan

- Build polycarbonate/high index capacity and sales

- Generate cash through inventory reductions, accounts receivables management and other initiatives

- Build the Enigma/Contour Optics business

- Fund, grow and support our Rx business

- Freestyle/other proprietary products and services

- Innovative dispensing tools

- Launch a differentiated, high performance AR coating (Teflon)

- Develop a new flagship progressive (“The Viper”)

- Grow our sun and sun Rx business

- Improve the quality of our marketing and communications

Focus on the customer was a strategy that varied in importance over time and by region. It tended to be relatively strong in the USA. In ~1990 Barry Weitzenberg, Petaluma Operations manager, noted “SOLA USA had a programme called Outward Bound where all of the senior managers and EP's hooked up with one of the sales managers and went out to visit customers. So I visited customers as a part of that programme. And then if we were having a problem – say a quality problem - or there's some other issue with a customer, then I went out and talked with them to try to work through what the problem was and be certain that we were providing the type of service that we should with customers.

I think it's absolutely critical that as many employees as possible have an understanding of what our customers business is. It just helps to put decisions that are being made into perspective.”

Mark Thyssen comments:

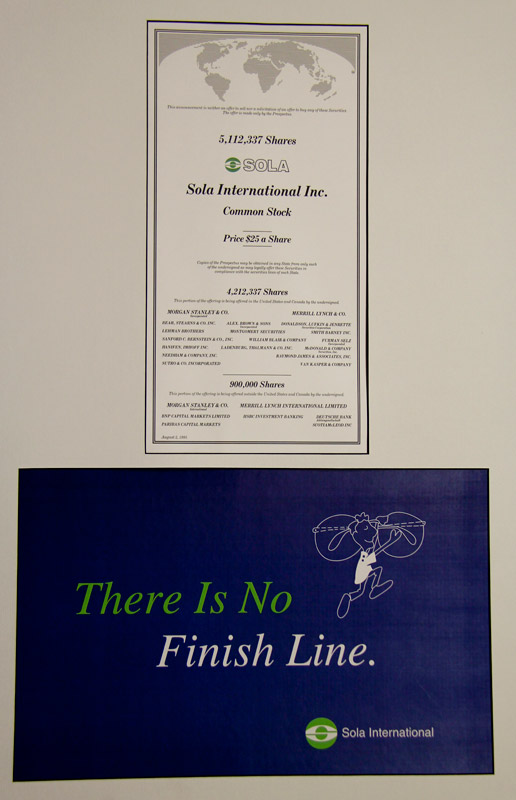

SOLA was a great company with a unique approach to business. Employees were fully committed to a “can do” approach. Customers, employees and company were at the heart of daily decisions and activities. However, listing on the NY stock exchange changed the company. The company objective, and said strategy, was ‘to grow shareholder value’. I have never considered this a strategy, but an outcome.

Various reasons for SOLA’s decline are recorded throughout this history update, especially in Sections 2 and 3. Another perspective is recorded below.

Some Issues that contributed to SOLA’s decline Ian Gillies

It is probably unfair to pin everything on John Heine but, as CEO, that’s where the buck has to stop.

I do think, however, that some of the management at SOLA USA must take some of the blame for SOLA beginning its sad decline.

In 1996/1997 a huge amount of expectation was created around MATRIX. Refer section 4.2 Snatching Defeat from the Jaws of Defeat: the Laminate Adventure by Peter Coldrey. Remarkable success was achieved in production of MATRIX wafers in CR-39 but Polycarbonate was always a difficulty. As the initial market opportunity was Lenscrafters, who absolutely only wanted Polycarbonate, this was a major problem. I believe that some SOLA USA management consistently underplayed the problems with Polycarbonate convincing John Heine that success was just around the corner.

I think this reinforced John in his opinion that the conventional Rx lab would become obsolete, which led to him being dismissive of Essilor’s strategy in the USA and elsewhere. As Essilor’s strategy began to bite SOLA USA started to discount the industry statistics which showed SOLA’s market share in the US for progressive lens was falling – They said that the total market figures were erroneous.

They were convinced that the SOLA product and the strength of the detailing team in promoting SOLA product to opticians would be powerful enough to create pull through demand that meant even ESSILOR owned Rx labs would be forced to supply SOLA product.

I myself attended a SOLA USA management meeting at which these views were expressed and I voiced my concerns to John. In fairness he tackled SOUSA management but came away convinced that all was well.

At the same time period SOLA USA changed their management incentive plan to one based on a “soft” budget instead of the required year-on-year growth and to have a list of “upside projects” to bridge the gap between budget performance and required performance. This became a nightmare situation to monitor, impossible to judge how much of the annual performance was due to which factors and, I believe, SOLA USA management became lazy, able to achieve their bonus without too much effort. This was a contributor to, what I felt was, their complacent attitude towards Essilor’s strategy and their own loss of market share. By the time John saw the reality it was already too late.

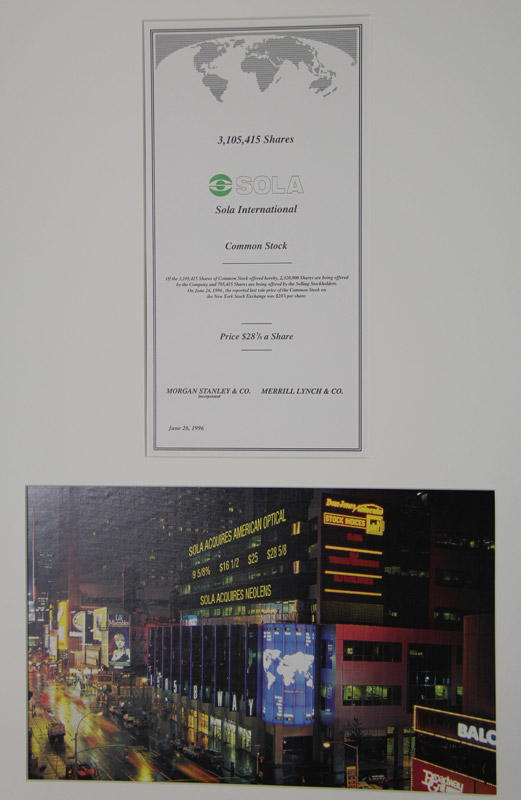

On the question of American Optical I believe that it was a good acquisition. We believed that there were significant opportunities for “fighting brand” progressives that SOLA could not pursue in its own name for fear of contaminating our brand image and our margins on Progressives, which were key to the financial health of the company. We negotiated hard and, through the work of myself and Errol Black, we identified areas where AO’s profits had been artificially inflated and were able to reduce the price from approximately US$120million to the $100million we paid. There were some very obvious profit improvement opportunities in AO, particularly at their manufacturing plants in Mexico and the business did deliver decent returns.

I think that becoming a Public Company changed SOLA. John became obsessed with his image in the investment world and became consistently less receptive to in-house ideas or criticism such that many people stopped contributing. At the same time the outstanding success of 1995 and 1996 created a level of complacency, particularly in SOLA USA, and a sense that continued success was almost inevitable. A lot of management time and energy was spent on “Duck School” and SOLA International Graduate Program, International Executive meetings and on the AO acquisition and issues such as Neolens and Miami were allowed to happen through indulgence of some misguided managers.

Home

Home Table of Contents

Table of Contents