4.5 Sunlens and Sun Rx

Sunlens and Sun Rx

SOLA has a long history of successfully making sunlenses, but the story remains largely untold in Breaking the Mold.

In the very early days, SOLA’s focus was on making planos mainly for sunlenses (while Essilor focussed on finished and Armorlite on SF). At various times, SOLA cast planos in Australia, Japan (bent sheet), Italy, Taiwan, Brazil and China (Xian). Brazil became the volume producer, casting 140,000 plano lenses/day at its peak in 2003.

During the Heine era, the formation of a coherent strategy that took sunlens from a seasonal after thought to a significant and consistent profit earner was the so-called GMD manufacturing strategy document. For the first time it laid out products, market size, estimated cost to manufacture, Capex requirements and all of the other bits and pieces needed to form a strategic view of the sunlens market. Once that was laid in front of him, John Heine figured it was worth laying some serious bets. From then on it took three successive sunlens division leaders to get, in 1999 to Gaetano Sciuto, who had the nouse to put it all together.

Today, Brazil still cast and tint CR-39 planos and China polycarbonate planos.

Sunlens Australia

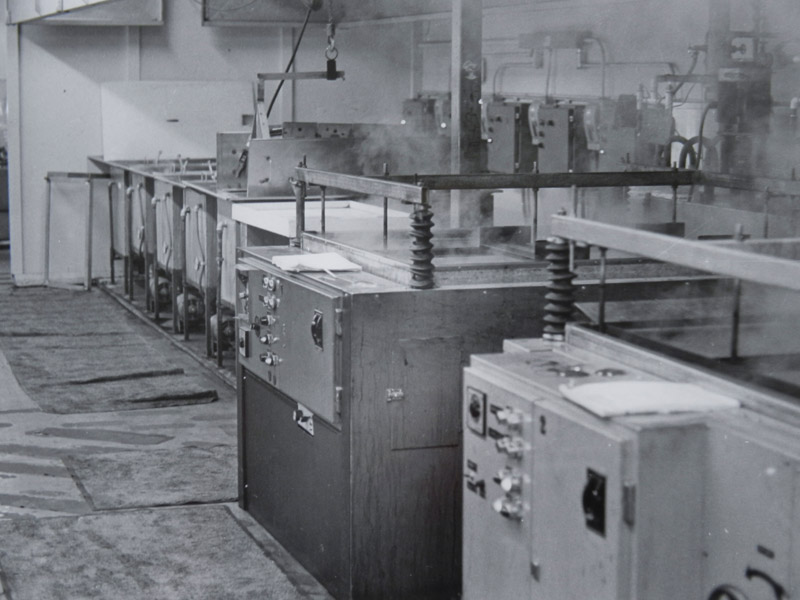

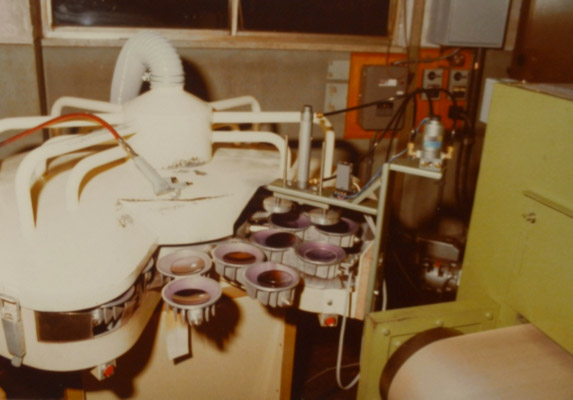

Lonsdale tinted plano lens volume peaked at 25,000 a day in the 1970s. Tinting was in special, in-house designed, baths and racks built to do full (solid) and gradient tinted sunlenses. Eventually the tint baths were sent to Italy, Brazil and Xian, China as Lonsdale wound down and these sites took over the volume manufacturing. Italy made some improvements to the Australian design tint baths especially for gradutints by replacing the mechanical cam with an electronic cam with an optical detector that was following a stripe of adhesive paper on a roll. However the baths remained essentially a 1970’s design which is still in use in Brazil today.

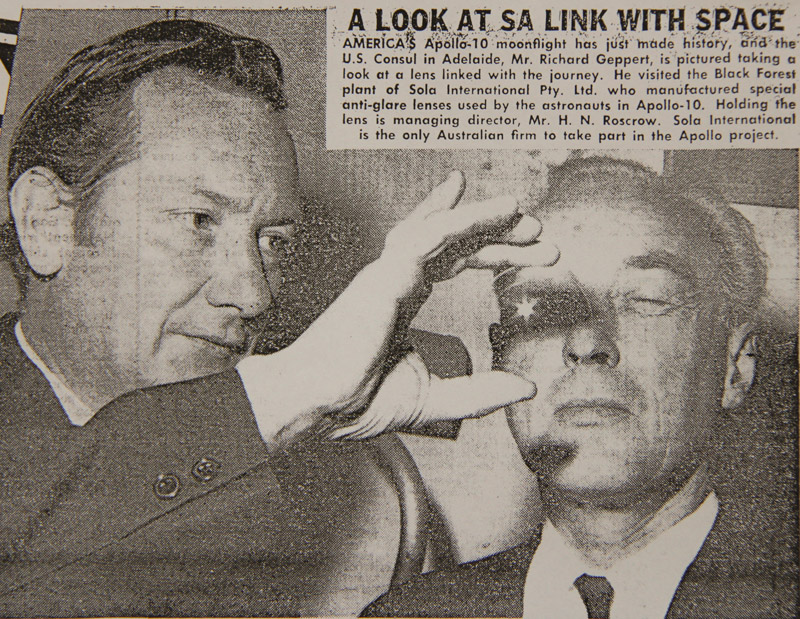

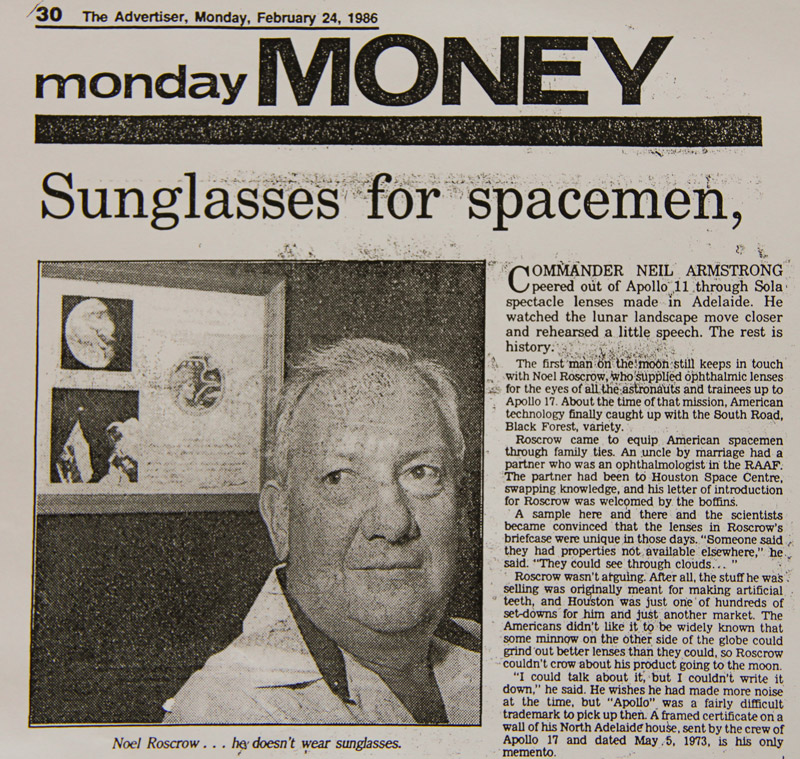

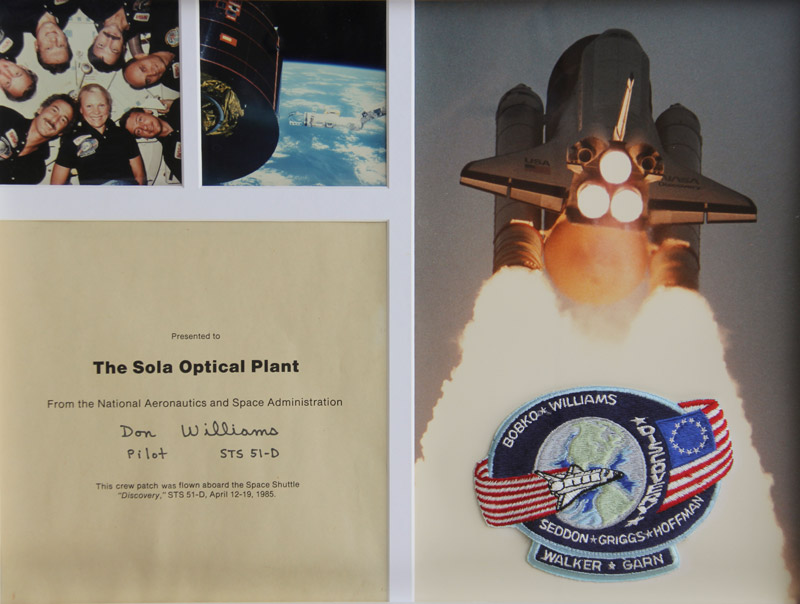

SOLA Australia developed a range of unique sunlens. One of the most successful was CRUVIRA, a neutral density sunlens that had good UV and IR absorbing properties. CRUVIRA lenses were worn by the US astronauts during the Apollo space missions. The lenses were made by suspending very fine particles of carbon black into pre-thickened CR-39 monomer, quite a difficult process to control. Many lenses went into the rubbish bin due to unacceptably high haze levels but the good quality lenses made excellent sunlenses.

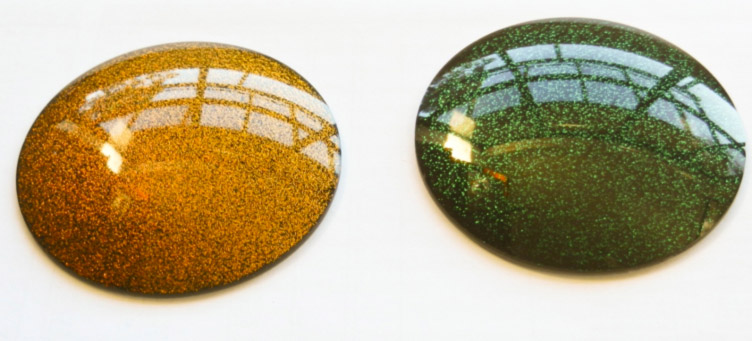

Another lens marketed as a fashion accessory to be worn at say parties and nightclubs was a brightly colored lens containing colored aluminium flake. The lenses looked quite spectacular but were a little difficult to see through due to the opaque aluminium flake. Noel Roscrow aptly called the green ones “frog’s eyes”.

The lenses were offered to a number of fashion companies such as Christian Dior who turned down the offer saying the lenses did not meet their strict optical standards. Thus the lens was not a big success.

SOLA Australia also developed considerable skills in tinting and dye formulations to tint a large variety of colors. For many years, SOLA successfully sold to Rx laboratories in-house formulated dyestuff for tinting ophthalmic and plano lenses. Eventually SOLA focussed on making lenses and left the dyestuff market largely to BPI (Brain Power Incorporated).

Sunlens Japan

SOLA Optical Japan Ltd was SOLA’s first overseas venture in November 1970.

Benny Sato was the first GM.

Bob Pearson, an Australian who settled in Japan after the Second World War was the Chairman.

Lens manufacture only commenced in SOLA Japan in the early 1980s in Osaka. A “bent sheet” manufacture process was installed to make cheap sunlenses.

To make bent sheet planos, a large flat sheet was cast. This sheet was then cut into squares the size of a sunlens, tinted and then bent via a vacuum former into a curve shape (like a normal cast plano). Once curved, the lenses were edged and fitted into frames in the normal way to produce sunglasses. The lens material was a CR-39/polyester blend as it had good curve retension properties. The in-house developed polyester was also much cheaper than CR-39.

The objective was to make cheap plano lenses that were inferior to CR-39, and the ones SOLA made certainly were inferior to CR-39. After several years, production ceased in Japan and SOLA reverted to only making normal CR-39 planos at other sites.

| Click on images to enlarge: | |

|---|---|

|

|

|

|

Sunlens Italy Michele D’Adamo

SOLA Italy first started to manufacture CR-39 planos in 1973, followed by stock lens and then semi finished. Plano casting grew to more than 70,000/day. In addition there was production of bent sheet planos – a sort of lower quality offering, initially using cheap raw materials such as the CR-39 monomer reclaimed from stock lens and semi finished casting to which methyl methacrylate was added. Additionally, bent sheet planos were also made for a number of years from a simple polyester and CR-39 mix developed by the Australian R&D team, i.e. the same formulation as was used in SOLA Japan.

The Italians politely described the tinting technology that they received from Australia as a ‘technology based on a very bold and simple manufacturing method’. The process of making gradutints using a mechanical cam arrangement to control the way the gradient was formed was particularly unreliable. Lino Barbieri and his fellow engineers developed an electronic cam with an optical detector that followed a strip of adhesive paper on a roll giving a setup that was much more flexible, reliable and maintainable.

Over the years SOLA Italy acquired considerable skills in tinting and mirror and AR coating plano lenses.

When polycarbonate started to capture a significant part of the sunlens market, SOLA Italy needed to get into that business. Making polycarbonate sunlenses was all new for SOLA. In 1995, on the direction of Barry Packham, Willie Rochford from Wexford, Ireland was seconded to help the Italians set up from scratch a polycarbonate injection molding and hard coating process. He and Italo Colombo (Italian engineer) starting by visiting the injection molding mold producers of SOLA’s sunlens competitors so as to figure out how to “reverse engineer” their process, i.e. to find out how they were making the molds for SOLA’s competitors. Within 6 months an injection molding set-up producing 4 polycarbonate lenses/mold was in operation. This was followed by a Eurocold dip coating machine.

The early 1990’s was a period when making sunlenses was much easier - not many customers, not many colors and at the same time life was relatively easy. It was not unusual to receive orders of 100,000 pieces of the same color of the same lens for one single big customer and the material of choice was CR-39.

But the market started to change; new customers, new applications and new materials started to be introduced. Polycarbonate, due to the excellent mechanical properties, was introduced and rapidly started to grow especially in the sport/lifestyle segment.

It was decided that the Italian sunlens plant had to quickly expand the production range in terms of materials and process and for this reason in 1996 a new team of people was hired and a first stage of investments were approved and implemented .

At that time, Alex Fernandez was the GM of the Sunlens division, Amedeo Negri was the Regional Director in Italy and with the arrival of Michele D’Adamo as the Plant Manager and Claudio Todeschini as Polycarbonate and Injection molding expert the Italian plant started to develop in a new dimension.

The first group of injection molding machines and the hard coating plant to manufacture polycarbonate lenses were installed in July 1996 and in a couple of months were already serving customers.

The objective of growing the number of products and processes was rapidly achieved and by the end of 1997 the Italian plant was one of the most complete in terms of materials, products, services to the sunglass industry. So the Italian organization quickly developed skills and new competences that were very well represented in Sabrina Malnati, the Quality and New Product Manager.

Sunlens Organization and Commercial Considerations

Les Kocsis arrived in 1998 (refer section on Sunlens Miami below for details) and Gaetano Sciuto a few months later. The primary objective of Les Kocsis from 1998 to 2000 was to use SOLA Sunlens as a marketing tool. The basic concept was to bring to life the concept of ‘Optics by SOLA’ and this objective was pursued as really the primary objective. However the returns of the division were not sufficiently high, so after 2 years, and all the things that happened in SOLA during that period (change of leadership from John Heine to Jeremy Bishop, etc), the leadership team of sunlens was changed and the headquarters was moved from Miami to Italy. This made sense because the major customers were now European and had a new approach - the sunglasses started to be considered in fact fashion accessories. Gaetano Sciuto was responsible for Sunlens Commercial globally following the departure of Les Kocsis. Michele D’Adamo was responsible for Operations globally and Roberto Porrini was responsible for Finance globally. In addition Miami as the headquarters location did not really have much sense as, apart from the cost, there were no longer big customers around there. From the closure of Miami and the initial restructuring of Sunlens in Italy, the results were immediate so within a few years and thanks also to a market that was growing at a double digit rate the Sunlens Division started to be very profitable.

At the same time the market was changing and new trends emerged and were not going in the direction to make life easier. The first trend was the shift of production of frames from Europe to China and this started to also generate demand of sunlenses in that region. From the late 1990s, there was a much higher penetration of the market of local Chinese companies which also started to change the rules of competition. While before most of the competition was between European and some American based companies. With the entry of the Chinese, the competition started to be very much oriented on price.

As well, some of the biggest customers such as Luxottica, started to pursue a vertical integration strategy. They decided to produce as much as possible internally and built their own factory to produce lenses. This had a huge impact on the industry as it reduced significantly the market available for the sunlens producers.

Polycarbonate Manufacture in China

The project to set up a polycarbonate manufacturing facility in China for producing sunlenses was prepared in 2005 before the merger with Zeiss. It was thought as a way to react to what was mentioned before, i.e. higher shift of production mainly from Europe and US to China, mainly frames. This meant the market for SOLA was moving to China and in order to serve this new market both from a service and cost point of view SOLA had to be a local manufacturer. It was not possible to serve China out of Italy and be able to be as competitive as the local competition.

Kong Ng was hired as a consultant to work on the project. He started to look at where to locate the factory which was very important. The preferred way for the customers, which were mainly Hong Kong based, to work was to buy lenses in Hong Kong and to ship and transfer them to their factories in China so as to have physical benefits when they were exporting from China. With this model in mind the best location in terms of services, infrastructure and in terms of our business model was inside the free trade zone in Guangzhou. Negotiations with the local authorities to get a long term lease on the factory site were successful and the factory was built to Sunlens Division’s specification. The approval was at the end of 2005 and production started at the end 2006 inside the budget of costs and within the timeframe.

The implementation was a success from a technical point of view because it was done within the timeframe and budget. From a commercial perspective the objectives were not met as the factory was not able to be filled for a long period. One problem was that polycarbonate became a commodity product and the local competition was very strong. Also some commercial assumptions were not really accurate. Currently the Sunlens Division is doing much better in China but it is because of the efforts to move CR-39 and different technologies into China. If the division was still relying on polycarbonate it would be with an almost empty factory.

The assumptions made on purely polycarbonate from a commercial point of view were not met. This was mainly due to the fact that the approval of the project took several years and this allowed our competitors to flourish and take market share while Sunlens Division was not operative in China.

Michele D’Adamo’s experience re sunlens in China is that the customer is a different type to those in Europe. In China, the main frame vendors are companies that are working for a Western company so they are not the end customer; they are an intermediate. This caused a lot of issues and also created more trouble especially from a quality perspective because they were much more stringent than the end customer – like a paradox – what is acceptable for, say Saffilo, is not acceptable for the company that is working for them in terms of quality.

Tinting technology advances

For most of SOLA’s history, tinting was more an art than a science both in terms of tint bath design and the method of applying the tints.

Currently from a procedural point of view it is still very much artistic but Sunlens Italy was able to introduce some more science. When tinting started to move to China, i.e. to the polycarbonate factory, a different way to tint lenses was required because if you could find an artist in Italy or Brazil, it is definitely not possible to find them in China – so a different design of baths and a different methodology using spectrophotometers and measurements and software to simulate colors was implemented. So there was a change in the last 3 years which removed, as much as possible, the artistic content of this type of production.

Gradutinting still requires some discretion of the operator and thus operators are very important. There was a development in the size and design of the gradient bath, even though the concepts are the same – but there is now a much better way of controlling the gradient – also more controls in the way the color is controlled using instruments rather than just using visual perception.

Sunlens Brazil

Plano sunlenses have been made in SOLA Brazil throughout its long history (1973 to current).

SOLA Brazil became the volume producer for SOLA, casting 140,000 CR-39 plano lenses/day at its peak around 2003. Efficient, high volume casting lines combined with a short (5 hour) cure cycle for CR-39 helped to maintain a cost-competitive position. SOLA Brazil also built up considerable expertise in both solid tinting and gradutinting. It was also involved in developing an ever increasing number of different plano products.

Today it still produces around 90,000 CR-39 plano lenses/day.

Sunlens Miami Tony Linkson

Initially, plano manufacture and sales were managed by each relevant casting site but a more formalised separate sunlens division was mooted as early as 1984. Jim Pritts was one of the early managers. However there was little progress largely because he and Ray Seco and Regina Pereira (Brazil was the volume supplier at the time) could not work together. The appointment of Alex Fernandez, a Cuban, saw a focus mainly on marketing SOLA’s range of Sunlens. Alex reported directly to John Wilen initially, and was based in Miami, USA.

Alex also had trouble getting the cooperation of Ray and Regina but was able to convince John Heine, in 1997, to set up a manufacturing facility in Miami. Alex’s focus was on getting the business of some of the better known US sunglass suppliers such as Smith, Arnette, Nike and Maui. Jim convinced John Heine of the need for speedy service, possible from a Miami facility but not from Brazil. An office/warehouse facility was leased just west of Miami airport and AR coating, mass tinting and edging facilities were installed. It was also a distribution centre for the full range of SOLA sunlenses including CR-39 from SOLA Brazil, polycarbonate from SOLA Italy, glass polarised blanks from Pilkington and polycarbonate polarised blanks from Japan and Korea.

Alex Fernandez “designed” the Miami facility, complete with a full gym that John Heine subsequently canned after Alex departed. After Alex’s departure, the business was managed by an Australian expat Les Koscis. He was the first of a number of employees of the Miami office who came over from Black and Decker. These included HR – Patty Avendaño, Sales – Ken Wallace and John Vignau, Latin American boss Brett Olsen, and numerous others.

Steve Daly and Willie Rochford from Wexford Ireland helped to setup the Miami facility to the point where the AR and the tinting equipment was commissioned. John Brooks, the production manager, then got it into production with help from a tinting support team from Brazil.

In mid 1998, Tony Linkson was seconded to help run the Miami manufacturing side of the business which included managing the small but diverse team of workers out the back. This included ladies from Cuba, Nicaragua, Dominican Republic, Columbia and Guatemala. There was not much English spoken out there, so Tony’s translation was all done by the capable engineer Patricia Gomez.

Les Koscis had an initial focus on getting sales of the business going ahead by doing deals with Nike, Smith, etc. In addition SOLA had a new lens type called Wide Eyes developed by Mike Morris that had a feature of reducing the distortion for peripheral vision and was aimed at sports people.

At this time, the Italian side of the business was also still very important, as Italy was home to a large number of the fashion sunlens brands. In 1999, Gaetano Sciuto joined the business, originally from Lotto shoes in Houston, but he was a Varese native and happy to go home to run the Italian Office.

In the early 90’s Italy expanded their existing facility to better service the Italian fashion industry with in-house injection moulded polycarbonate, mass tinting, AR coating and edging.

Also, the sunlens manufacturing part of SOLA Brazil which was being run as a separate business from the ophthalmic division also came under control of Les Koscis in Miami.

The most important aspect of the Sunlens division at the time was the attempt to leverage the use of SOLA lenses in famous name sunglasses to try to gain some form of market brand recognition of SOLA. This was based around a logo and the term “Optics by SOLA”. The plan was to get people like Nike and Smith to use the logo on their packaging and on swingtags attached to the sunglasses. In conjunction with this, the Miami based Sunlens Division had a truck and caravan that was a mobile “Optics by Sola” billboard and showroom used at the Beach and various shows to highlight the SOLA brand alongside the brand name sunglasses. A press release:

MENLO PARK, Calif.--(BUSINESS WIRE)--March 30, 1999--SOLA Sunlens, a division of Sola International Inc., announced that it has signed an agreement with NIKE, Inc. to become the exclusive supplier of sunglass lenses to Nike Vision, Nike's athletic performance eyewear division.

Nike will place the SOLA logo and phrase "OPTICS BY SOLA" on its sunglass packaging, product and promotional materials.

"Building brand name recognition is one of SOLA's key growth strategies," said John Heine, President and CEO of SOLA International. "Establishing a co-branding agreement with a market leader such as Nike is an important step for us."

All Nike sunglasses will feature SOLA Tough Eyes(TM) lenses, SOLA's new highly durable, scratch-resistant polycarbonate lenses. SOLA uses only ophthalmic-grade resin, made in a new state-of-the-art manufacturing facility. Tough Eyes(TM) offers consistent ophthalmic-quality optics, excellent visual performance and comfort.

"As the leader in the industry, our products and technology can create many compelling reasons to purchase Nike sunglasses. We will immediately begin to jointly develop co-branding materials and place them on Nike product, packaging and promotional literature," said Les Kocsis, Vice President/General Manager of SOLA Sunlens Division. "In addition, SOLA will assist promoting Nike sunglasses through its own recently launched event marketing program. The major focus will include Nike-sponsored events, as well as SOLA's independent sports marketing program."

"SOLA is committed to developing formal business programs with key brand partners to grow sales jointly. SOLA Sunlens division has innovative new products, exciting branding and event marketing programs, and resources to increase the sales of our co-branding partners," added Mr. Kocsis.

At the time, the focus was on “Optics by SOLA” supported by global co-branding and events marketing (such as at NASCAR races) - “money was easy” - Les Koscis decided to set up a Sunlens University and a showroom to highlight the features of the Mike Morris designed sunlens. This consisted of a special display room to highlight the various brands of sunglasses. This room had a SOLA logo on the floor, speciality water jet cut-out in the UK made from black and white lino. Then a meeting room, complete with a handmade board room table that cost US$10,000. Then the playroom for testing the lenses, which consisted of a special pond where you fished out items and a car body that connected to a Sony Playstation enabled you to drive with the glasses on, and also a series of test machines to check your peripheral vision. The final cost but it was around US$250,000.

The first “Optics by SOLA” logo was a horrible mix of 3 or 4 colours. The SOLA truck and caravan was a Ford F350 painted black and plastered with the awful logo. Eventually it was changed to a simpler and much classier black and white logo. Since the truck was no longer “cool’ enough, it was dumped for a new and more expensive white Dodge truck and repainted caravan to match the new black and white.

At that time, there were frequent meetings where all of the Sunlens managers got together to discuss how well they were doing. The first one was held by renting out the whole top floor of a hotel on South Beach, Miami. The next one even topped this by doing the same thing in an old boutique hotel just near Grand Central station in New York with dinner at Morton’s steak house on 5th Ave, i.e. in a private room at one of the most expensive steak houses in the USA.

Very quickly the cost of “running” the small Miami facility became uneconomic and the levels of work coming in were just not sustainable. The manufacturing side was closed down late 1999 with the office closing down completely in 2000 and the day-to-day running of the division went to Gaetano Sciuto in Italy.

By the end of 2001 the worldwide set up was:

Sun Rx

Sun Rx was identified as a key opportunity but despite several false starts over a number of years never resulted in anything significant - clearly a lost opportunity for SOLA.

Matthew Cuthbertson noted during a Rob Linn interview in November 1997:

Sunlenses is something that SOLA sort of stuffed around with for a long time and really got serious about it in the last couple of years. There are huge opportunities for us to marry the creativity and the expertise we have here to the sunlens business in lots of innovative ways..... Well, the nice thing about the sunlens side is that it's already well down the fashion appliance track and it has very well developed brand names, and a real fashion element. You know, there's a lot of money in that, and there's a lot of opportunity for product differentiation.

The SOLA Sun Rx Business Plan dated 19th January 2000 stated:-

The product line incorporates various lens shapes, treatments and tint colors that are prevalent in the branded sunware market together with the unique product characteristics of SOLA’s initial targeted brand partners (Nike, Jeep, Native)

Initially SOLA will offer:

- A wrap lens design (Spazio) in the four top tints in their design category and one polarized

- A flat lens design (SolAspheric) in the three top tints in their design category

In addition SOLA will have available an inventory of untinted SF blanks to efficiently accommodate the demand for specialized tint colors

The financial objectives by year 3 were to generate:-

- Annual sales of US$21,290k

- Gross margin of US$11,235k

- Net cash flows of US$4080k

The 2002 North American AO-SOLA strategic plan stated:- the polarized market in the US at 4.5% had doubled in the last three years and represented an excellent opportunity for sales growth in a consumer oriented product that will be supported by dispensers as enhancing second pair sales. The SunRx market is also underdeveloped with only 20% of eyeglass wearers purchasing prescription sunglasses. To capitalize from these opportunities AO•SOLA will:

- Launch a SunRx program through SOLA Technologies in Q4 FY01/02 both as an OEM service to retail chains (LensCrafters/Sunglass Hut), Nike and opticians.

- Develop effective partnerships with Nike and other SOLA Sunlens customers to grow a premium prescription sunglass business and simultaneously build a premium image for SOLA Technologies.

- Launch a polarized product line for the traditional business in Q1 FY02/03 in single vision and progressive lenses (Percepta, AO b’Active, single vision) using Younger NuPolar® technology.

Home

Home Table of Contents

Table of Contents