4.4 Rx

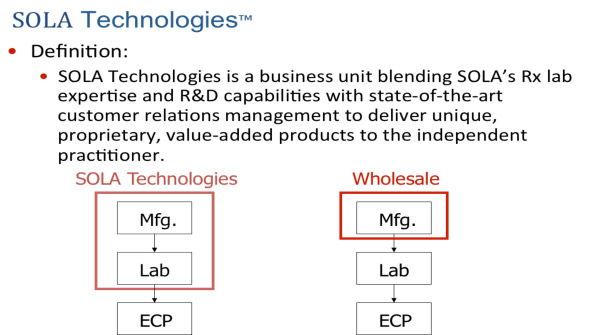

Delay in SOLA responding to the trend of vertical integration Karen Roberts

i.e. do nothing while Essilor and Hoya bought up many Rx laboratories around the world – laboratories that used SOLA lenses. Essilor’s strategy to vertically integrate coincided with SOLA’s pursuit of the Matrix in-office manufacturing system that some thought would reduce the dependence on prescription laboratories to deliver finished prescription and coated lenses.

SOLA’s need to react too was raised at many of the strategy discussions in the various A-Team forums with many arguing SOLA should also follow Essilor’s lead and vertically integrate. To some extent this was also driven by increasingly complex products and the associated laboratory technologies needed to process them.

In September 1996, the lens strategy team proposed investing in a Special Order Business (SOB) Centre:

- Capable of producing special-order lenses for wholesale laboratory customers.

- Allowing SOLA to compete with competitor owned laboratories and strengthen the relationship with existing laboratory customers....sends the right message that SOLA is helping them do business. Increases SOLA’s reputation for technology leadership.

- Provide a way of offering Dual PD fitting without creating a headache for the labs, and other product opportunities such as ICON, back side Rx atorics, fully customised progressive Rx’s, special coatings, etc.

At the time John Heine was receptive to the idea and Mike Morris and Karen Roberts were actioned to prepare a detailed proposal on the Special Order Business for a pilot service centre based in Petaluma.

However Jim Cox was emphatically against us getting into competition with our customers and this idea eventually got thrown out at the following A-Team meeting in March 1997. (It was said that when Lenscrafters prospered SOLA prospered so there was resistance to do anything that would get Lenscrafters off-side.)

Another unsuccessful attempt to get into the laboratory business was argued in late 1997 when SOLA USA was expanding their rapidly growing UTMC business with a network of custom coating labs to process SF.

A number of joint ventures and alliances were entered into to provide AR coating capability across North America. This ultimately included both UTMC licenses to partner labs and the acquisition of some labs with strategic distribution capability. Once again the compelling arguments to get into the lab business were outweighed by the commercial nervousness of being seen to compete with our customers, so the surfacing part of the labs were sold off and only the custom coating capability to retained. One last ditched attempt to retail one centre as the SOB hub was also firmly rejected.

In the meantime Essilor, were obviously not suffering the same pangs of concern about competing with their customers and so they continued to acquire labs and extensively expand their lab network, not just in North America but around the world.

Ironically Essilor at one point in time was one of SOLA’s biggest customers until they successfully migrated the Essilor lab’s customers to Essilor product, ultimately reducing SOLA’s access to the market through their stranglehold on this distribution channel.

With the acquisition of American Optical in 1996, SOLA could finally supplement its lab operations in Italy and Japan with a large lab presence in France and a smaller lab in the UK. John Heine’s initial instinct was to sell off the AO lab business units, but Bernie Freiwald, Ted Gioia and others convinced him to retain the labs and continue the focus on the Direct to Retail business in Europe.

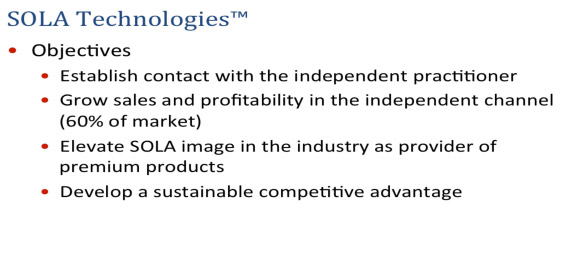

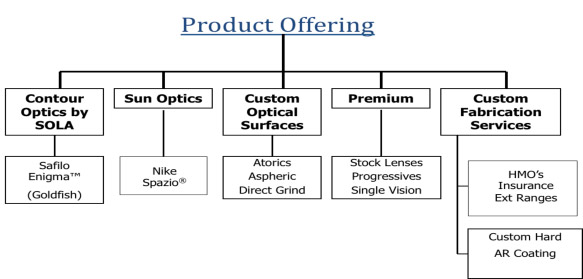

With the change in management from John Heine to Jeremy Bishop, the company was finally ready to react to the new market paradigm and get into the lab business in North America as well. In January 2001, a proposal was presented to the board for a specialty Rx Lab business. The business was pitched around the need for high technological capability to make and deliver Contour and Sun Optics, but was auspicious in its capability to also delivering a full portfolio of products to the market.

SOLA was finally taking its first steps to building a global Rx lab network.

Since Essilor and Hoya had already purchased a large number of the bigger and more capable labs, SOLA was then faced with the challenge of developing a strategic footprint in terms of distribution and capability with careful selection of strategic lab partners.

Arguably the rapid advent of new technology such as Freeform makes some of the earlier lab investments by Essilor and Hoya less relevant as the conversion to new infrastructure and behaviour is more cumbersome. Essilor has taken steps to address this by buying one of the two major suppliers of Freeform equipment to the industry – SatisLoh.

Recollections of SOLA’s history in Rx Laboratories

compiled by Mike Pittolo from information provided by Derek Mernagh, Barry Lannon, Italo Colombo, Claude Labeeuw and others

Asia and Australia

SOLA Australia ran a small Rx lab for many years, mainly providing out of range work for customers in Australia and sometime the Middle East. In 1985 when I start at SOLA it was run by Jim Mott, and my recollection is that many of the lenses used were rejects recovered from casting in Plant 1. One of the first projects I was involved with was the implementation of SLIMLITE, a 1.56 RI material into casting. I remember to this day Jim Mott explaining to me that compared to glass, he thought CR-39 was bad for surfacing, that was until he had to process SLIMLITE, which was far worse!

The operation in Australia remained small for quite a while partly as it had no coating capability. In the late 80’s early 90’s after the acquisition of Coburn, two old Satis 725 coating machines were transferred from the US and the Australian lab first got into the AR coating business. Because the machine was non-ion assisted and because of the problems associated with AR coating Permagard, the AR coating was applied over bare CR-39. Ironically many years later, one of the Satis 725 was transferred to R&D, upgraded with and Ion Gun and was used as a tool to develop TEFLON AR coating.

In June 1995 Optical Eyeware was acquired by SOLA from Colin Paice and became the foundation of an expanded Rx operation in Australia – in fact the only “manufacture” on the Lonsdale site is now Rx. SOLA was lucky as some of its key local personal had a good relationship with Colin who offered his business to SOLA after Essilor had made him an offer. Without this key Rx laboratory SOLA/CZV’s presence in Australia would be even lower than it is today. At the time Optical Eyeware was operating one Rx lab in Adelaide (at Heath Street) and had smaller branches in Sydney and Melbourne. Upon the acquisition by SOLA, a full UTMC production facility was installed in Heath Street and the Rx operation from Plant 3 was also transferred to the Heath Street facility. Later (~ 2003) UTMC facility would also be added to the Sydney branch. By the time of the merger with Zeiss, Optical Eyeware, which was now call SOLA Technologies was operating in Adelaide, Sydney, Brisbane, Melbourne, Perth and Auckland producing in excess of 2,000 Rx jobs per day. This included production of UTMC and TEFLON AR coated product and the burgeoning Freeform lenses (SOLAOne HD and other optimized progressive designs).

Japan, ironically has an important role in SOLA’s Rx history. In the early 80’s our joint venture operation with NSG (SOLNOX) was producing a high quality AR stock lens product based on TS56H dip coating (hard coating from Tokuyama Soda) and new Ion Assisted AR coating process (using Shincron equipment). The transfer of this basic process to SOLA Italian Rx operations was a major success and the main reason for growth in the Italian market. But Japan also had an Rx operation for a short period of time during the late 90’s. At the time rimless frames were becoming popular, and CR-39 was not able to support these as it was not strong enough. At the time SOLA was not producing MR hi-index materials which would later become the “standard” for hi-index (1.6 and 1.67) and rimless. However SOLA USA was producing Polycarbonate lenses and Yamamotto-San the then head of SOLA Japan realized the opportunity for high end rimless work based on polycarbonate. For 2-3 years the SOLA Japan Rx operation produced some of the most expenses Rx lenses sold by the company, achieving retail prices of ~ US$1,000 per pair of spectacles.

SOLA had operated a mold making facility in Singapore since 1975. The first recollection I have of making finished Rx lenses in Singapore was the production of finished E/Lines for the USA market. In the late 1990’s? the Rx operation was formerly separated from the Mould Making operation and investments in AR coating were made. At the time of the merger Singapore was making about 300 – 400 jobs per day, most of which were AR coated and supplied predominantly to Singapore, although some were also sold into Malaysia.

SOLA operated a small Rx lab in Malaysia. Some investment in second hand AR coating equipment was made, but we struggled to get this up and running. The lab never really prospered and at the time of the merger was only producing ~ 100 jobs per day, surfaced only.

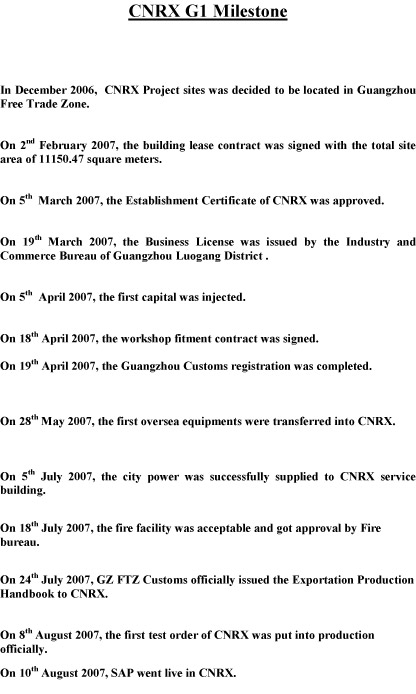

In China small Rx operations were opened in Beijing and Shanghai around the time (1997-8) a new Mass Manufacturing plant in Guangzhou was being developed. Again the Rx labs were set up with second hand Rx equipment with limited hard coating. Later an Rx lab was also established in Guangzhou which could use the mass manufacturing AR coating facilities to support Rx lenses. The Rx operations in Beijing and Shanghai were closed down in the early 2000’s with production being consolidated in Guangzhou. At the time of the merger, the lab was producing ~ 400 jobs per day.

The lab in Guangzhou, called CNRx G1, started production in August 2007. G1 is now the second largest lab in CZV at ~ 14,000 lenses per day. The lab is part of a CZV "campus" of Mass Manufacturing, Sunlens and Rx factories in the Guangzhou area.

Europe

Production of Rx lenses in Italy started in 1975 as Franco Gaslini has a strong intuition that this was the way of the future. The Italian plant experienced some setbacks with floods in 1976. The big change in Rx production came in 1991, when based on the processes used in Japan, UTMC production was started. Unfortunately, there was a second flood in 1992. In 1993 SOLA started TV advertising direct to the final customer and by 1994 SOLA had become the leading producer of Rx lenses in Italy.

In 1995 the 4th flood to affect the factory, put one meter of water through the facility, prompting the decision to relocate the factory. This finally happened in 1998, when Rx and the Sunlens division moved in a purpose built, and higher facility a few kilometres from the original factory.

In 1999 after the acquisition of AO, the factory also started producing and selling AO brand Rx lenses.

By the time of the merger in 2005, Italy was the company’s second largest Rx laboratory producing > 2000 jobs per day. It was producing UTMC, TEFLON and also Freeform lenses. In addition there was about 9 depots though Italy tinting and edging lenses for fast service.

In addition to developing UTMC, staff in Italy, particularly Fabrizo Andreani, Italo Colombo, and Alberto Codari also supported the roll out of UTMC to locations like Portugal, Kentucky, Australia, etc. as well as working closely with R&D on the development of TEFLON. Italian staff also supported various Sun Rx initiatives and the development of new edging equipment such as “Mon-Sphera” machine, from MEI. These are now pretty much industry BDP for edging Rx lenses to frames.

SOLA UK started out as a cast to Rx facility. Around 1986 this stopped and production of Rx lenses with standard Rx equipment expanded. After the acquisition of AO, SOLA and AO operations were combined into a single operation in Birmingham which produced Rx lenses with UTMC and TEFLON coatings.

SOLA had been selling S/F lenses to a small laboratory in Portugal since 1990. In 1995 the lab burnt down and SOLA supplied Rx lenses to them until they could get back up and running. In 1997 SOLA signed a UTMC license deal with the lab resulting in the UTMC process being installed. The ongoing relationship with SOLA led to the full acquisition on the lab in 1999.

Like a number of other Rx labs, SOLA’s Irish lab in Wexford started out as an off-shoot of the mass manufacturing plant. The first Rx lenses were produced on St Patrick’s day 1990. In 1995 they won a contract to supply Thompson Trading Denmark with Rx lenses which was later to become SOLA Nordic. Up to the time of the merger SOLA Nordic and back up supply to the UK and Belgium markets were the main stay of the Wexford laboratory.

In 1997, SOLA also acquired the Rx Operations of a Belgium customer – DeMunck. UTMC AR processes were installed and in the 2000’s, attempts were also made to install TEFLON, but there were difficulties with their equipment. In late 2004 the lease on the existing facility expired. Given the small volume produced, Capex investment for a new facility could not be justified and the business was closed down.

When SOLA bought AO, we acquired our largest Rx Laboratory, situated in the Brittany town of Fougères. François Bès de Berc was the charismatic GM of AO France who drove the business to one of SOLA largest, by developing a close relationship with the Afflelou chain and its owner Alain Afflelou. This allowed the French operation to grow to > 8,000 job per day, of which 65% were for Afflelou. François was support ably by Jean Luc Viel, a driven production manager, sometimes with a take no prisoner attitude. Technically Jean-Luc was well supported in the IT area by Marcial Carbot-Saban, who was instrumental in developing Rx calculation packages and the like and Bob Grace, an expatriate American, who was the Engineering manager for a number of years. AO France success with Afflelou was based largely on their willingness and ability to react at short notice to major promotions and if required, bent some rules to support their customers.

At the time of the merger AO France were producing ~ 8,000 jobs per day, with UTMC, TEFLON and Freeform technology as well as warehousing and distributing Afflelou frames. They had embarked on a number of investments in automation and labor saving, sometimes, with success, but always with an aggressive, can do, fiercely independent approach.

USA

The history of Rx production in the USA is somewhat different to other regions where small Rx facilities in mass manufacturing plants eventually grow into larger businesses. In the US there was never any Rx production in Petaluma and there was often strong debate whether to get into the Rx business and what if any was the best approach. (Refer previous section ‘Delay in SOLA responding to the trend of vertical integration’ for more detail.)

Eventually in the late 1990’s SOLA bought a share in a custom AR coating operation run by a former employee (US Custom Coaters, owned by Mark Porden). Mark had worked in the SOLA R&D team at Petaluma for a number of years where he learnt the basics of AR coating. On leaving SOLA he set up his own custom coating operation in Portland Oregon based on reconstructed Shincron AR machines.

Around this time SOLA was also developing the “Enigma” product which was a highly curved lens, requiring specific frames (with Safilo) and specific fitting techniques. It is not clear whether this was a “stalking horse” of the US team, but John Heine agreed to set up a “Specialty” lab to support Enigma, and hence the Kentucky Rx lab, had it beginning. In Jan 2001 the construction of an Rx lab in the same building as SOLA North American distribution centre in Kentucky began. By September 2001, with poor performance of Enigma in the US market, it was decided to buy SOLA Technologies USA, the company’s first full service Rx laboratory in the US. Many people contributed to the growth of the Kentucky lab through a difficult time trying to develop a profitable business. At the time of the merger the operation was profitable and producing ~ 500 – 700 job per day including TEFLON, UTMC and Freeform.

Between the years 2001 and 2005, the need to develop a wide coverage of Rx labs in North America was clearly understood. A number of acquisitions were made driven largely by Mark Ashcroft and Claude Labeeuw and then by Barry Packham.

In 2002 Rx laboratories in Boston and Virginia (South Eastern and B and W) were acquired. In 2003 Souixland (Sheldon and Iowa City) KCO (Kansas City Optics) and Laser (Phoenix, Arizona) were acquired. In 2004 VisionSystems (Virginal and Atlanta) a former Zeiss operation were acquired along with SOLA’s larger Rx operation in US Great Lakes Customer Coating and Rx Laboratory in Troy, Michigan.

In 2005 just after the merger, three more Rx operations were acquired, viz Optical Plastics, which was located in the same facility as SOLA Custom Coatings, Specto (in Los Angeles) and North Central (in Minnesota).

Also at this time the existing Zeiss Lab in Canada became part of the North American lab Network.

In 2008, Zeiss and VSP (primary Eyecare insurance provider in USA) bought a Joint Venture lab in Florida (Perfect Optics).

South Africa, South America and Mexico

Acquisitions of the GENOP labs in South Africa occurred in Jan-04 and again in Mar-06. Mark Bieg was seconded from the Australian Rx operation to run the lab for several years.

In late 2004, SOLA acquired one of the largest Rx lab network in Brazil, Quality Labs owned by Edson Mello, a Brazilian national.

In October 2008, a large (at ~ 8,000 lenses per day) and successful Rx lab was set-up on the same location as the Mexican casting factory.

Rx – Global Coordination Jon Westover

Operationally, Barry Packham had been doing a lot on Supply Chain in the early 2000s and driving that agenda, but Rx was out of Operations and sitting in the Regional Commercial structures with zero operational know-how apart from the local leadership teams driving anything - no regional focus, no global focus, no standardization, and no focus on metrics. It was 100 islands of unique operational capability. The lack of performance resulted in CEO Jeremy Bishop in July 2003 transferring all Rx operations worldwide into Global Operations. Jon Westover was moved from his OSM leadership role to take up responsibility for this new Global Operations accountability – (see Operations Structure-Oct-03) Jon’s role was to start driving a global approach to Rx and his thrust was to follow a very similar philosophy to what was in manufacturing:-

- Getting people to work together (cross functional teams),

- Starting to use the same data set and costing methodology with standard metric sets so that service, yield and through-put were reported in the same way

- Driving the best demonstrated practice agenda

- Looking to have networks of labs in regions. There were Europe, Americas, Asia-Pacific and Rest of World regions with a lead lab in each location which was Lonsdale for Asia-Pacific, Kentucky for Americas and France and Italy for Europe and the others were islands still

- Closing of loss making labs, e.g. Rx Belgium

- Acquisitions of labs in Africa (GENOP Jan-04 and Mar-06) and India

In 2003 – 2004 another key activity was Project Lamborghini which was the standardized lens manufacturing technology, i.e. a calculation software using the lens management tool called Rx 2000 which was developed in Lonsdale for cutting lenses in a standard way so that if a lens cut in one lab was then sent to another lab, the data order entry was such the cut lens looked like it was expected to look, e.g. a lens made in Italy and sent to France met France’s expectations. This was a big job and took a lot of work to implement.

The other big project at the time was the improvement of the Kentucky lab. The most complex technology had been installed without the necessary staff capability. So Jon Westover got the job to fix Kentucky. Jon hired Mike Browning, a capable person from Essilor, who reduced some of the complexity by transferring some specialty Rx manufacture, and just focused on the basics for nearly a year. The result was that the lab went from a US$2.0 million loss to a US$1.2 million profit in about 18 months. Kentucky then became the lead lab for the Americas as it was the only relatively large lab at up to 2,000 jobs a day. All the other labs that were being acquired in parallel were small (100 – 300 jobs per day) as SOLA was very late to focus on Rx and all the available good labs had already been purchased by Essilor.

The other big project at that time was Project Harley with Sean Holt Project manager, Daryl Zoromski Commercial leader and Jon Westover the overall leader. Project Harley was about expanding the SOLA lab presence through acquisitions and also introducing Teflon AR coating into 10 labs and creating the commercial capability to supply Teflon as SOLA’s licensed AR coating trying to recover some ground lost to Lenscrafters, Crizal, etc.

Another initiative was to identify and establish specialty labs, e.g. IOLA in Portugal, which after getting it capable, was setup to manufacture all glass Rx lenses for Europe, e.g. migrating glass from the Italy and France labs to IOLA.

Home

Home Table of Contents

Table of Contents